M&A projects of Life Science companies – what prevents success?

Part 2: Tecan`s SPE-Resolvex exploration.

Tecan`s 2016 acquisition of US-based SPEware Corporation, now the Resolvex brand or Tecan SP, is expected to strengthen its consumables business in “automated” mass spectrometry sample preparation. A payment of USD 50 million was agreed for a California garage company that developed a positive-pressure workstation (no automation) and underperforming SPE consumables. I joined Tecan as Sales Development EMEA for liquid handling at the beginning of 2017, at which point the deal had been finalised but the portfolio had yet to be introduced in Europe. The SPE consumable business from SPEware was specifically developed for clinical diagnostic SPE sample preparation, with a focus on drug of abuse testing—a significant concern in the United States. As a result, SPEware achieved remarkable success in launching its workflow to major diagnostic laboratories such as LabCorp, where several hundred drug of abuse samples are processed daily using the SPE workflow. Many instrument providers recognise that most revenue stems from consumables, so these deals are logical. However, drug abuse testing has not posed significant challenges in Europe, as standard diagnostic laboratories typically process approximately 50 samples per week without implementing an SPE workflow. Other sample preparation markets—such as those for environmental testing or drug discovery in biologics—lacked an established presence, allowing competitors to capture the revenue. Furthermore, an automated positive pressure workstation was not prepared for deployment, which could be considered a logical expectation for an automation company. The management chose to address the portfolio gap for clinical diagnostics; however, this led to the emergence of a new gap in the Tecan portfolio. Following multiple discussions with clinical diagnostic end users, I observed that SPE workflows are utilised exclusively for two applications: steroids and catecholamines/metanephrines. With that knowledge, my lab team created in 2018/2019 a new application note for “multi-steroid extraction from saliva or serum using positive pressure SPE for automated LC-MS sample preparation” to enter the clinical market. However, the typical laboratory only processes about 50 samples per week, so it isn’t a large-scale business opportunity. Based on this preliminary progress, Tecan IBL proceeded to develop a new LC-MS CE-IVD kit using SPE consumables, which was subsequently launched in 2023 – a late success. Following this success, Tecan IBL will discontinue developing its own LC-MS CE-IVD kits—possibly due to slow progress—and instead pursue an OEM partnership with Diagnotix NL to enter the clinical diagnostics market, as the IBL ELISA segment has been declining for years. Another issue involved the delayed launch of the A200, a semi-automated positive-pressure benchtop workstation that faced quality problems. Addressing the quality concerns took some time, and integration in liquid handling platforms’ support was only provided years later. Furthermore, the proposed SPE consumables did not meet performance expectations, and there was no response from the management board regarding this issue. As a result, the first year of commercial operations in Europe yielded a disappointing outcome, with revenue falling below target (Tecan SP business unit). Recognising potential for small businesses in clinical diagnostics, I began investigating markets such as proteomics and biologics drug discovery, since these fields demand significantly higher sample throughput and greater automation needs. In proteomics, we partnered with ISAS Dortmund to develop a Semi-Automated Positive Pressure SPE for Phosphoproteomics using our A200 positive pressure workstation, although they did not use our consumables. The Tecan SP (Resolvex) features an innovative NBE column design, incorporating a membrane on top for tryptic digestions, not dripping, followed by C18 resin to enrich peptides. However, the primary design focus was for matrix removal, resulting in proteins binding to the membrane, which reduces the detected features in a proteomics LC-MS screening. Despite these challenges, further investment in the development of these advanced proteomic columns did not occur, allowing competitors such as Agilent Bravo and PreOmics to establish themselves in this area. During our second year entering the EMEA market, we successfully implemented automated protein purification and plasmid preparation workflows using an integrated A200 workstation through a liquid handling station in two major pharmaceutical R&D departments. However, Tecan was not responsible for the integration. Once again, we lacked consumables for these applications and no further 96- or 24-well plates for protein capturing were developed.

In summary, the proposed business case, namely, the enrichment of consumable sales, was not implemented. We achieved some instrument sales, but in different markets, as expected. SPEware primarily concentrated on a single market, and its portfolio was not yet positioned for market expansion. Additionally, the positive pressure workstation was not prepared for automation integration, and the performance of the SPE columns was significantly deficient. I repeatedly encouraged management to adapt the portfolio, but after three years, I was satisfied and left Tecan. Although I enjoyed my work and grew professionally, the lack of responsiveness was too significant. When you make a deal, you need to develop the transaction with R&D budget; otherwise, you fail (for all Corporate Developers with an MBA).

PS: The corporate development market analysis used data from 90% US customers for a European go-to-market strategy.

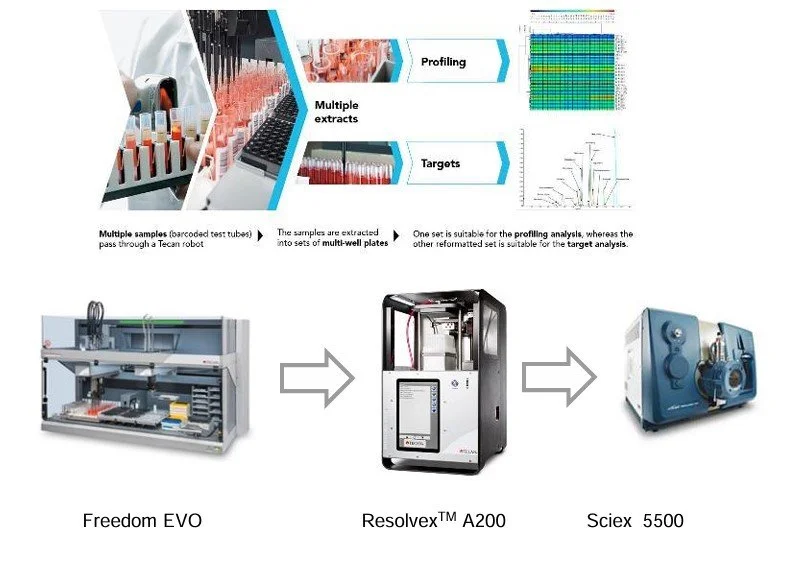

LC-MS sample prep workflow from our application lab in Hamburg